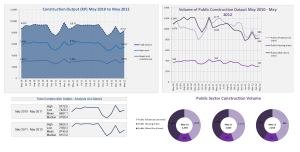

Great British Period on Period Construction Output Falls for Fifth Consecutive Quarter

November 9, 2012 Leave a comment

Figures released by the Office for National Statistics today show a fall in output in 7 of the 9 defined sectors. The largest fall being in the private commercial sector.

As the graphic below illustrates, the infrastructure sector has been one of the few growth areas over the past quarter although, output is still a way off the same period a year previous.

Here is a link to the ONS publication and dataset if you want more detail:

PUBLICATION

DATA

http://www.ons.gov.uk/ons/publications/re-reference-tables.html?edition=tcm%3A77-262512

In other (equally dismal) news, my progress is slow with the construction share price data presentation and insight. I have a fully functioning spread sheet including charts, heat maps, interactive tables, etc. (which I use to aid trading decisions), yet its translation to the web is fraught with difficulty, mostly thanks to my lack of coding knowledge! I will persevere and hopefully it will be up within the next couple of months. In the meantime, I will start to post more regular Construction Company market insight and analysis in the form of charts and commentary which will become more interactive once I get the hang of this coding business.